student loan debt relief tax credit application for maryland resident

Eligible people have 16 days to. How to apply for Marylands student loan debt relief tax credit.

The Full List Of Student Loan Forgiveness Programs By State

Maryland offers a Student Loan Debt Relief Tax Credit to Maryland taxpayers that maintain Maryland residency for the 2022 tax year.

. Mississippi has a graduated income tax rate ranging from 3 to 5 and Minnesotas graduated tax rate spans from 535 to 985. The state is offering up to 1000 in. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

State Comptroller Peter Franchot says these persons can apply for the. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans. Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000.

The credits goal is to aid residents of the Chesapeake Bay state who. T he deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming up in just over two weeks. There isnt a set amount thats released for the.

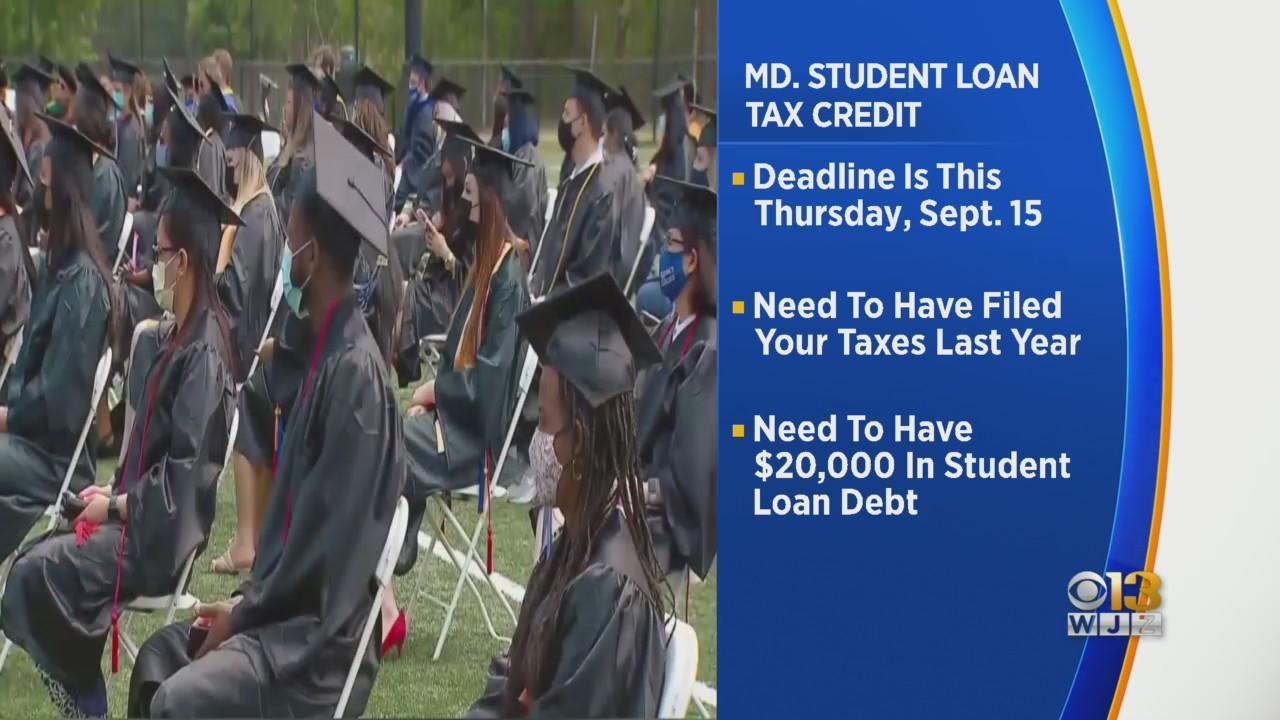

Annapolis Md KM Maryland residents who are burdened by student loan debt can get some relief. The student loan forgiveness application closes. 23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept.

Federal student loan borrowers only have until the end of 2023 to apply for one-time forgiveness through the. If you receive student loan forgiveness in. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

In order to qualify for the tax credit you must be a Maryland resident file state income taxes have incurred at least 20000 in student loan debt and have at least 5000 of. Complete the Student Loan Debt Relief Tax Credit application. Credit for the repayment of eligible student loans.

Going to college may seem out of reach. T he deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming up in just over two weeks. Otherwise recipients may have to repay the credit.

Student Loan Debt Relief Tax Credit. You must claim Maryland residency for the 2022 tax year. More than 40000 Marylanders have benefited from the tax credit since it.

Eligible people have until Sept. The credit is claimed when filing your Maryland tax. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to.

September 14 2022 757 pm. Eligible people have 16 days to. How much money is the Maryland Student Loan Debt Relief Tax Credit.

15 to apply for a Student Loan Debt Relief Tax Credit of up to 1000.

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wbff

How To Apply For Maryland S Student Loan Debt Relief Tax Credit Central Scholarship

States Step In Relieving The Burden Of Student Loan Debt Rockefeller Institute Of Government

Maryland Student Loan Tax Credit Tiktok Search

Marylanders In Need Urged To Apply For Student Loan Debt Relief Tax Credit Wbal Newsradio 1090 Fm 101 5

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Youtube

Student Loan Debt Relief Tax Credit Application Due Sept 15

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

Maryland Student Loans Debt Statistics Student Loan Hero

Student Loan Borrowers In 7 States May Be Taxed On Their Debt Cancellation Npr

Tax Credit 2022 Deadline For Maryland Residents To Claim 1 000 Student Loan Debt Relief Credit Is 18 Days Away Washington Examiner

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Tax Credits Deductions And Subtractions

What To Know About Student Loan Forgiveness For Doctors Fox Business

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wbff

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

The Student Loan Forgiveness Application Is Live But Will You Owe Taxes On Debt Relief Cnet

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/VYWYQDIL5JBHRA2IWLYTRJ3NAI.jpg)

President Joe Biden S Student Loan Plan Means A Nearly Debt Free Future For Some Baltimore Residents Baltimore Sun